Simple Guide for New Business Owners

Starting your own business is exciting, but figuring out how to pay yourself can be confusing, especially if you’ve set up an LLC (Limited Liability Company). In this guide, we’ll walk you through everything you need to know about paying yourself from your LLC in simple terms.

What is an LLC?

An LLC, or Limited Liability Company, is a type of business structure in the U.S. It’s popular with small business owners because it offers flexibility and protects your assets (like your car or house) from business debts or lawsuits.

LLCs can have one owner (called a single-member LLC) or multiple owners (calleda multi-member LLC). You can also choose how your LLC is taxed, which affects how you pay yourself.

Why It’s Important to Pay Yourself the Right Way

Paying yourself correctly isn’t just about getting money into your personal bank account—it’s about staying compliant with tax laws and keeping your business finances organized.

If you do it the right way:

- You avoid IRS problems.

- You keep personal and business money separate.

- You understand how much money your business is making.

Step 1: Understand How Your LLC is Taxed

How you pay yourself depends on how your LLC is taxed. There are three common tax options for LLCs:

1. Default Taxation as a Sole Proprietor (Single-Member LLC)

If you’re the only owner and haven’t elected a different tax status, the IRS treats your LLC like a sole proprietorship.

2. Default Taxation as a Partnership (Multi-Member LLC)

If your LLC has two or more owners, the IRS treats it like a partnership, unless you choose another tax type.

3. Electing S-Corporation or C-Corporation Tax Status

LLCs can choose to be taxed as an S corporation (S corp) or C corporation (C corp) by filing special forms with the IRS. This changes how you pay yourself and how much tax you might owe.

Let’s look at how you pay yourself under each type.

Step 2: Paying Yourself from a Single-Member LLC (Sole Proprietor)

If you’re the only owner and have not chosen S corp or C corp taxation, the IRS sees your LLC as a “disregarded entity.” That just means they treat it like you and your business are the same person for tax purposes.

How Do You Pay Yourself?

You pay yourself by taking what's called an owner’s draw.

- You transfer money from your business account to your account.

- You don’t pay yourself through payroll.

- You don’t withhold taxes when you pay yourself.

However, you still need to pay self-employment taxes and income taxes when you file your tax return.

What Records Do You Need?

Even though you’re just transferring money, always:

- Keep a record of each draw.

- Make sure the money is available in your business account.

- Use a separate bank account for your business and personal finances.

Step 3: Paying Yourself from a Multi-Member LLC (Partnership)

If your LLC has more than one member and hasn’t chosen corporate taxation, it’s taxed like a partnership.

How Do You Pay Yourself From an LLC?

Each owner gets an owner’s draw based on their share of the business.

For example, if you and a partner each own 50% of the LLC, you’ll each be able to draw 50% of the profits.

What About Taxes?

- Each member pays self-employment tax on their share of the income.

- The LLC files a Partnership tax return (Form 1065) and issues each member a Schedule K-1, showing their share of the profit.

Again, you do not pay yourself using payroll unless your LLC has elected corporate taxation.

Step 4: Paying Yourself from an LLC Taxed as an S Corporation

Some LLC owners choose to have their business taxed as an S corporation because it may save money on self-employment taxes.

How Do You Pay Yourself?

S corps require more formal payment methods. You must do both of the following:

- Take a Reasonable Salary:

- Pay yourself as an employee using payroll.

- You must withhold federal income tax, Social Security, and Medicare taxes.

- Your business must also pay the employer share of payroll taxes.

- Take Distributions:

- In addition to your salary, you can take extra profits as distributions.

- These distributions are not subject to self-employment taxes, which can save money.

Example:

- You pay yourself a salary of $40,000.

- At the end of the year, you take an extra $20,000 in profit as a distribution.

Important Notes:

- The IRS requires that your salary be “reasonable.” You can’t avoid payroll taxes by taking a tiny salary and big distributions.

- You’ll likely need help from a bookkeeper or payroll service.

Step 5: Paying Yourself from an LLC Taxed as a C Corporation

If your LLC is taxed as a C corporation, your business is a separate taxpayer.

How Do You Pay Yourself?

- Salary:

- You are treated as an employee.

- You receive a paycheck and pay payroll taxes.

- Dividends:

- If the business makes profits, it can distribute dividends to shareholders (including you).

- Dividends are taxed again on your tax return—this is known as double taxation.

Is C Corp Status a Good Idea?

C-corp status is usually best for larger companies or those planning to reinvest profits or seek outside investors. It’s not always ideal for small LLCs.

Step 6: Set Up a Business Bank Account

No matter how your LLC is taxed, always open a business bank account. This keeps your money separate from your finances and makes accounting much easier.

Use your LLC’s bank account for:

- Getting paid by clients

- Paying business expenses

- Paying yourself

Step 7: Don’t Forget Taxes!

When you pay yourself, you still need to plan for taxes. Here’s what to keep in mind:

Self-Employment Taxes

If you’re taking owner’s draws (sole proprietors and partnerships), you’ll owe:

- 15.3% in self-employment tax (Social Security + Medicare)

- Plus federal and state income taxes

Estimated Taxes

You may need to make quarterly estimated tax payments to the IRS. These are due in:

- April

- June

- September

- January (of the next year)

W-2 Taxes

If you’re an S corp or C corp and paying yourself a salary, your business will handle:

- Withholding taxes

- Payroll tax filings

- W-2 at the end of the year

Which Option Is Best for You?

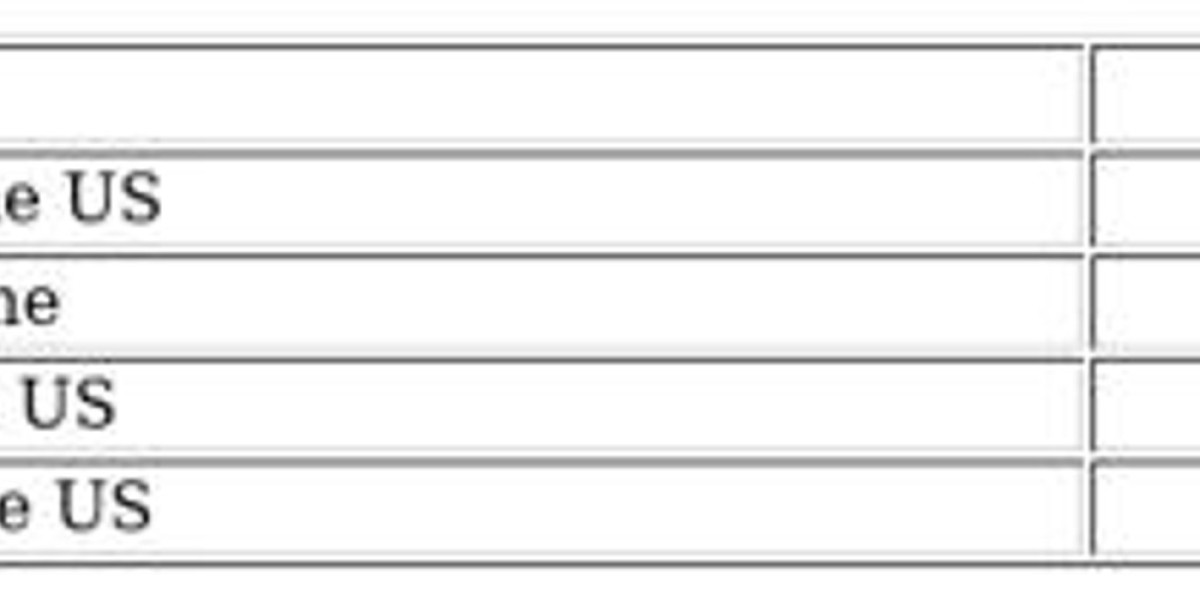

Here’s a quick comparison:

| Tax Status | How You Pay Yourself | Taxes You Pay | Best For |

|---|---|---|---|

| Sole Proprietor | Owner’s Draw | Income + Self-employment taxes | Simple, one-person LLCs |

| Partnership | Owner’s Draw | Income + Self-employment taxes | Multi-owner LLCs |

| S Corporation | Salary + Distributions | Payroll taxes + Income tax | Saving on self-employment tax |

| C Corporation | Salary + Dividends | Payroll + Corporate + Income tax | Large, growing businesses |

Final Tips for Paying Yourself the Smart Way

- Talk to an Accountant: Taxes and rules can get tricky, especially with S-Corp or C-Corp setups.

- Use Accounting Software: Helps track income, expenses, and your payments.

- Keep Records: Always document how much and when you pay yourself.

- Pay Yourself Regularly: This helps with budgeting both personally and for the business.

Final Thoughts on Paying Yourself from an LLC

Paying yourself from an LLC depends on how your business is taxed. The simplest method is the owner’s draw for single or multi-member LLCs taxed as sole proprietors or partnerships. If you choose to be taxed as an S corp or C corp, you’ll need to take a salary and possibly distributions or dividends.

It might seem complicated at first, but once you understand the basics, paying yourself becomes routine. Just make sure to separate your business and personal finances, follow IRS rules, and plan for taxes.

Want help deciding which payment method fits your business? Talking to a tax pro or CPA can make a big difference.

Need Help Navigating LLC Payments and Compliance?

At EOR Services UK, we make it easy for business owners to stay compliant and confident when paying themselves or their team. Whether you're setting up payroll, choosing the right tax status, or just need help with the financial side of running an LLC, our experts are here to guide you every step of the way. Let us handle the complexities, so you can focus on growing your business. Get in touch today and discover how we can support your success.